PRIVATE EQUITY

High-Growth Opportunities in Startups and Private Companies

Invest in the future with private equity—gain ownership in startups and private businesses poised for growth. Partnering with trusted market facilitators like Issuing Houses and Trustees, investors access exclusive, high-potential deals beyond public markets. While long-term, these investments can deliver strong returns for strategic, patient capital.

Invest in the future with private equity—gain ownership in startups and private businesses poised for growth. Partnering with trusted market facilitators like Issuing Houses and Trustees, investors access exclusive, high-potential deals beyond public markets. While long-term, these investments can deliver strong returns for strategic, patient capital.

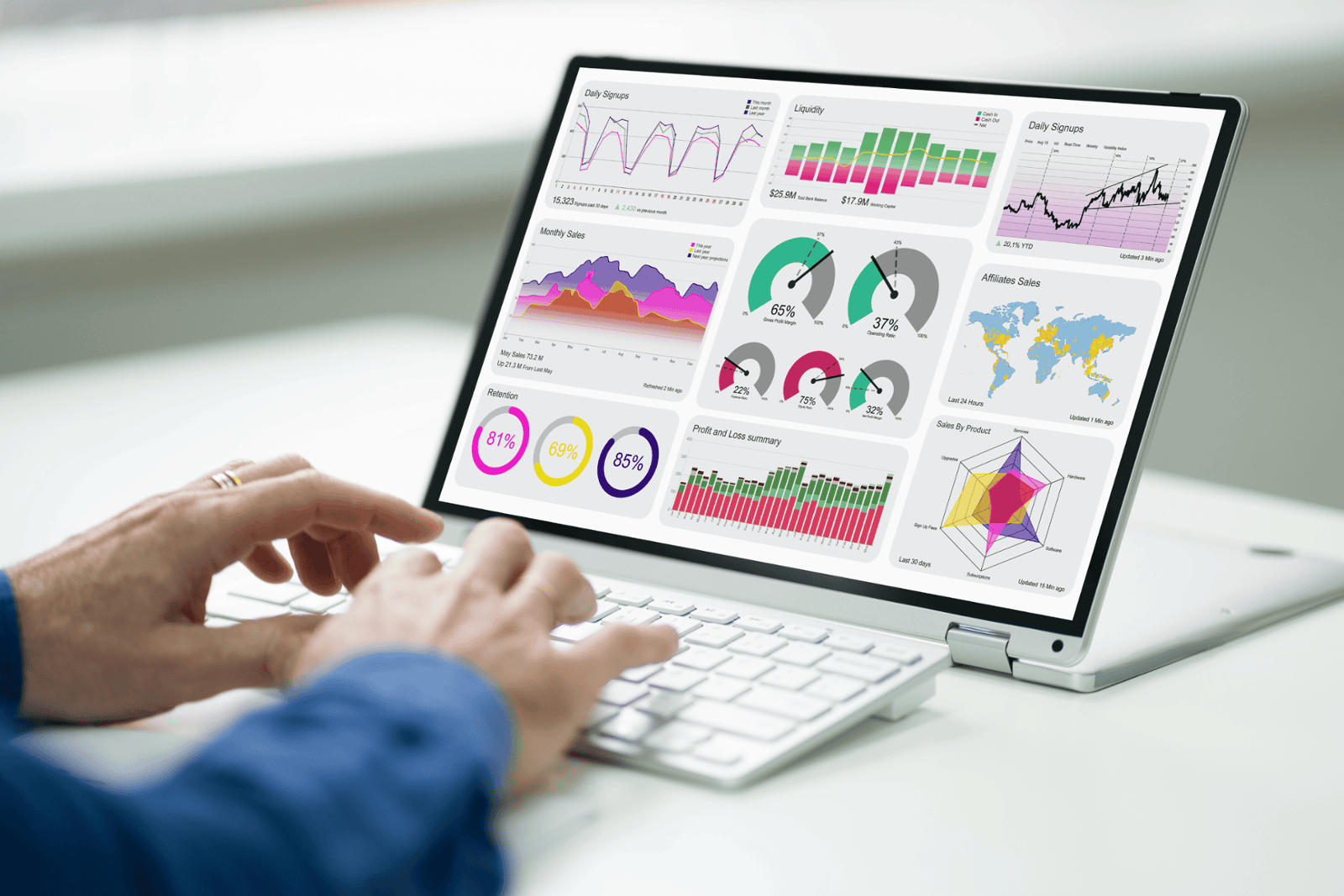

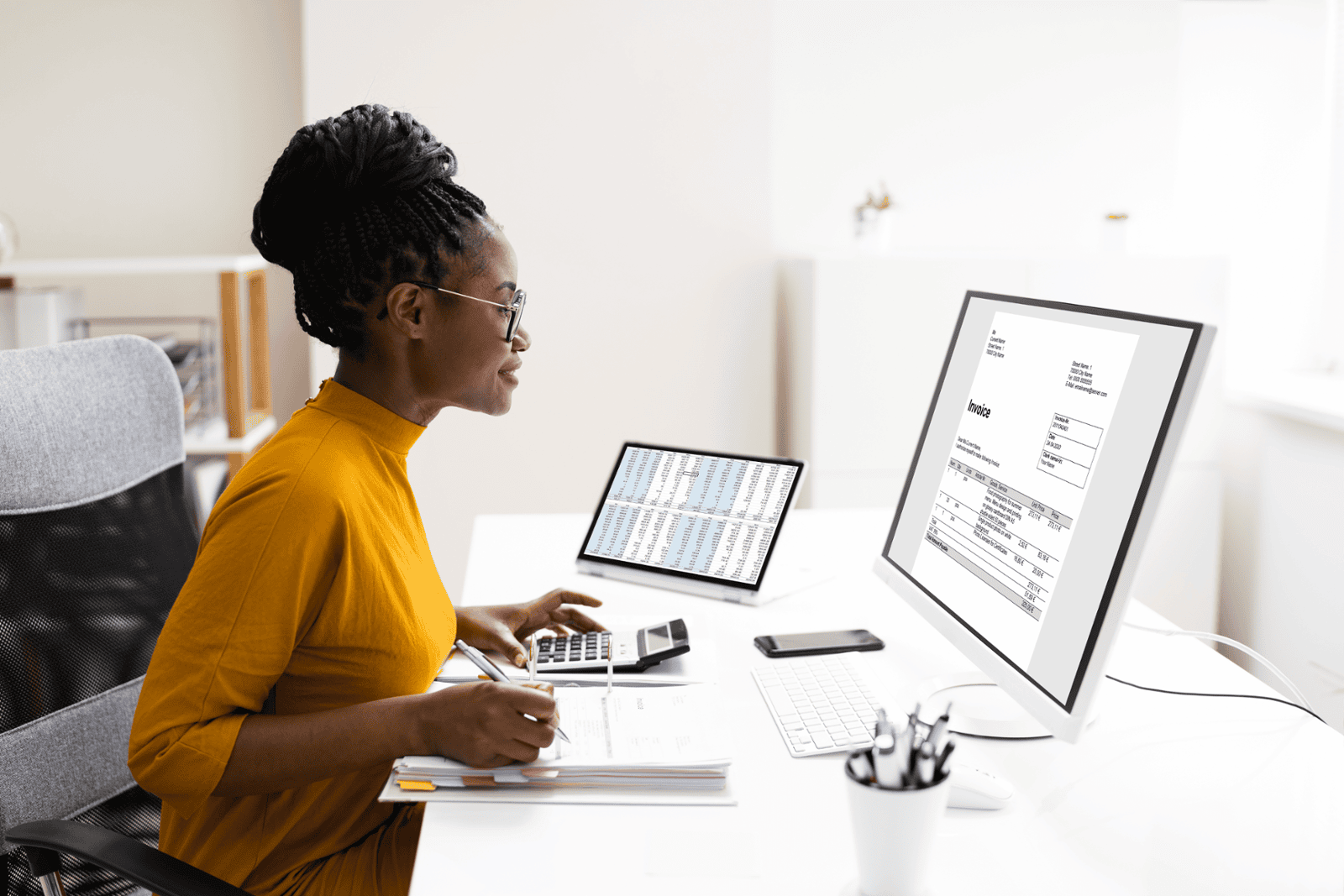

ALTERNATIVE ASSETS

Smart Debt Instrument for Financing and Asset-Backed Investment

Unlock smarter capital solutions with TradeX and AltaPrime Notes. TradeX Note provides flexible short-term financing for invoice discounting, distributor support, and LPO-backed funding. AltaPrime Note gives investors fractional access to high-value alternative assets—real estate, infrastructure, gold, and art—driving portfolio diversification and long-term value.

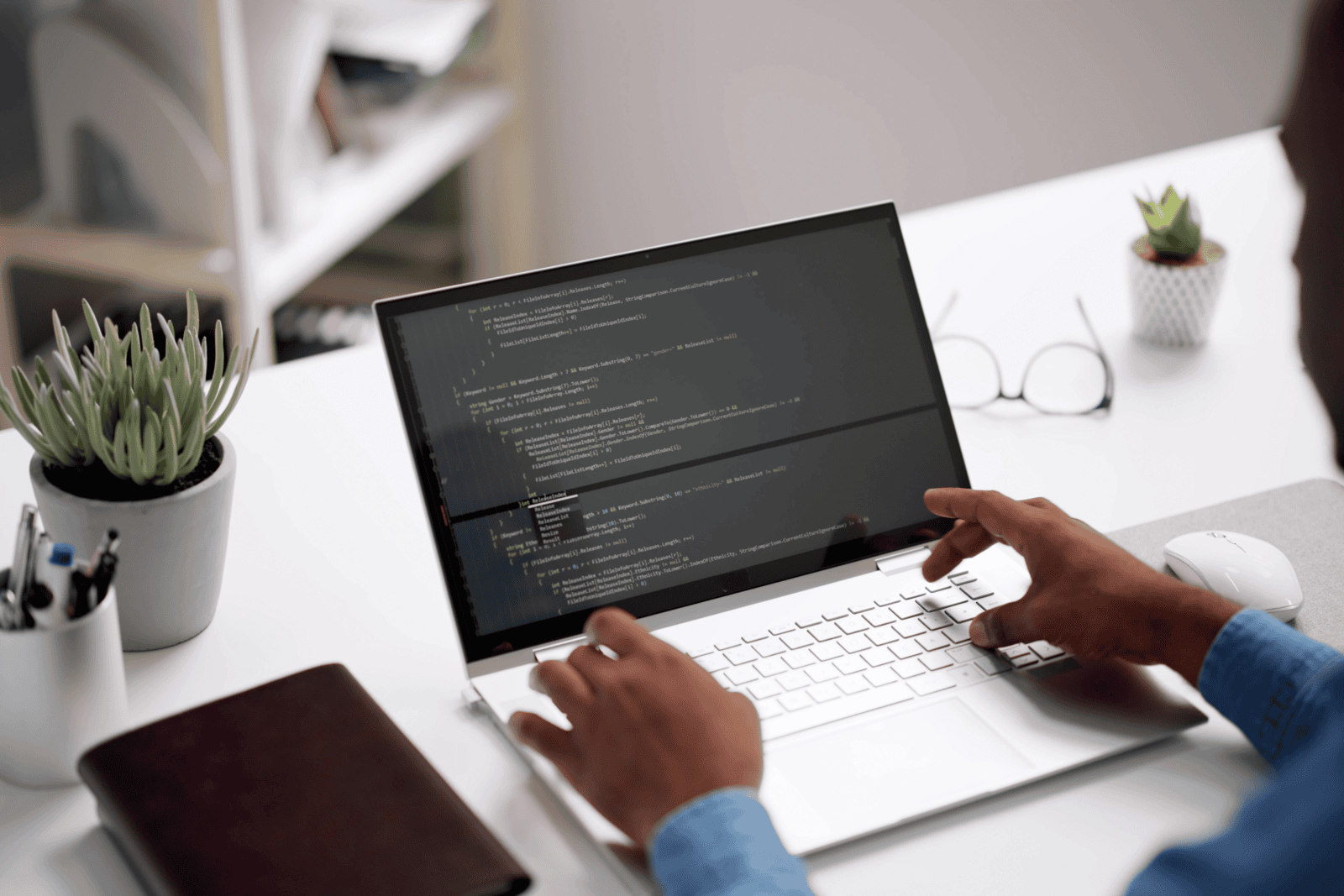

SECONDARY MARKET

Unlock liquidity in private investments

Seamlessly buy and sell private securities through our transparent secondary marketplace. Gain access to a dynamic range of opportunities—private equity, private credit, and structured debt. Whether exiting or rebalancing, investors can unlock value from existing portfolios while enhancing flexibility in today’s evolving private markets.