STARTUP AND SME CAPITAL

Fuel Innovation with Funding, Mentorship and Global Investor Access

Through our Creative Innovation Lab, startups and SMEs gain access to funding, grant support, expert mentorship, and growth-focused training. Whether developing products, entering new markets, or scaling operations, businesses can showcase their potential and connect with global investors ready to back their vision and drive success.

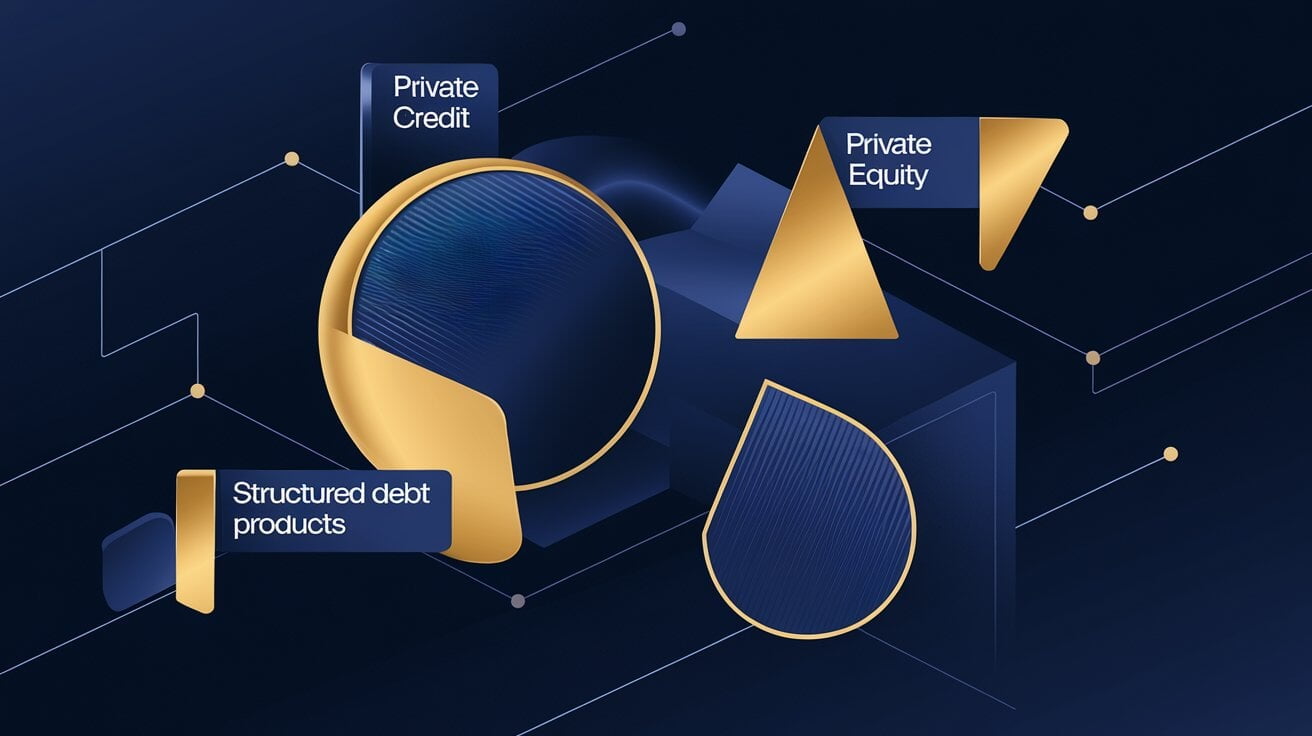

PRIVATE SECURITIES LISTING

List, Manage, and Distribute Private Securities with Confidence

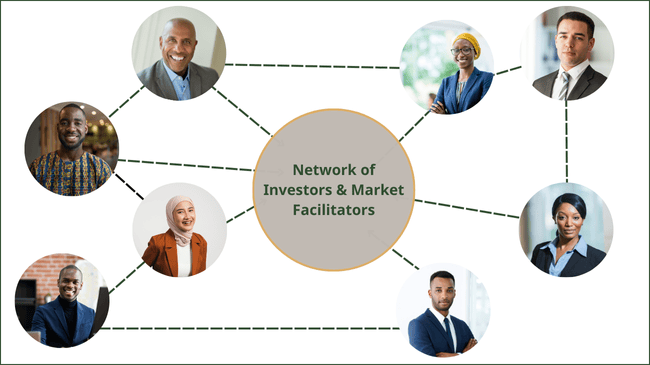

Streamline the listing of your company’s securities through our trusted platform. Work with a vetted network of Issuing Houses, Trustees, Legal Firms, Rating Agencies, and Depositories to ensure compliance and market readiness. Gain investor visibility, leverage targeted distribution, and access secure custodial services—all in one seamless, fully regulated environment.

Streamline the listing of your company’s securities through our trusted platform. Work with a vetted network of Issuing Houses, Trustees, Legal Firms, Rating Agencies, and Depositories to ensure compliance and market readiness. Gain investor visibility, leverage targeted distribution, and access secure custodial services—all in one seamless, fully regulated environment.